Thread Bank Business Deposit Account Agreement Disclosures

Topkey Business Deposit Account Program

Last updated: October 27, 2025

The following Thread Bank Business Deposit Account Agreement Disclosures (the “Disclosures”) applies to the interest-bearing demand deposit account (the “Account”) issued by Thread Bank (the “Bank”), member of the Federal Deposit Insurance Corporation (“FDIC”) and chartered under the laws of the State of Tennessee. These Disclosures are incorporated by reference into the Thread Bank Business Deposit Account Agreement (the “Agreement”) and Thread Bank Business Visa Debit Cardholder Agreement (the “Cardholder Agreement”). Topkey, Inc. (“Program Partner”) is responsible for assisting the Bank with the administration of the Topkey Business Deposit Account Program (the “Program”). Capitalized terms not otherwise defined herein are ascribed the same meaning as set forth in the Agreement.

1.1 How to Contact Us

For most matters, you should email us at support@topkey.io, support is available Monday–Friday, 9am-5pm EST. The Program Partner’s website is available at https://www.topkey.io/.

If your debit card, debit card number, or PIN is lost, stolen, or misplaced; fraud alerts program or support or if you would like us to stop a recurring debit to your debit card, please contact us at 1-800-847-2911.

For questions or concerns about any non-card transactions, including, but not limited to: (i) suspected errors or unauthorized EFTs; or (ii) if you would like to place a stop payment request for preauthorized transfers, please contact us at support@topkey.io.

If applicable, for questions or concerns about adding and/or deleting Authorized Users; checking your current interest rate; substitute checks or check standards; or closing your Account, please contact us at support@topkey.io.

For questions or concerns about updating your name, address, or other contact information; identity theft; reporting account takeover; checking the status of a transaction; or providing instructions regarding a transaction, such as direct deposits and other incoming ACH transactions, please contact us at support@topkey.io.

1.2 Account Types and Tiers

We offer four (4) types of Accounts: Regular Deposit Account, High Yield (HY) Deposit Account, Bill Pay Account, and the Non-Interest Deposit Account.

The Regular Deposit Account is your default Account.

The HY Deposit Account is a separate operating account that helps you segregate and manage pre-booking deposits more effectively, holding funds that are collected ahead of guest bookings. Once the booking has been completed, you will pay out a portion of the amount to the owner of the property, less any fees and expenses and your commission.

If you have a Regular Deposit Account or HY Deposit Account, you may apply for the Bill Pay Account and/or Non-Interest Deposit Account. The Bill Pay Account may only be used to hold funds for bill pay. Approval for the Bill Pay Account and Non-Interest Deposit Account is in our sole discretion.

The Accounts that you have may affect your transaction limits, interest rate, and annual percentage yield as set forth in this Agreement. Unless otherwise stated in this Agreement, all terms contained in this Agreement apply equally to all Accounts.

1.3 Paperless Account

To open an Account, you must agree to go “paperless.” This means that you must (a) provide us with and continue to maintain a valid email address and (b) accept electronic delivery of all communications that we need or decide to send you in connection with your Account by agreeing to the ESIGN Consent Document, located at https://www.topkey.io/electronic-signature-disclosure-and-consent.

1.4 How To Open an Account

You may open an Account by visiting the Program Partner’s website at https://www.topkey.io/and following the instructions there.

1.5 Minimum Deposits and Balances

There is no minimum deposit required to open an Account and no minimum balance you need to maintain in your Account.

1.6 Interest Disclosures

Bill Pay Account and the Non-Interest Deposit Account are not interest-bearing. No interest will be paid on the Bill Pay Account and Non-Interest Deposit Account.

The interest rate on your Regular Deposit Account is variable. The interest rate and annual percentage yield may change at any time. Your interest rate is based on 85% of the midpoint of the Federal Reserve funds rate, multiplied by .46.

The interest rate on your High Yield (HY) Deposit Account is variable. The interest rate and annual percentage yield may change at any time. Your interest rate is based on 85% of the midpoint of the Federal Reserve funds rate, multiplied by .89.

Interest on your account will be compounded and credited on a monthly basis. If you close your Account, you will receive any interest that has accrued as of the date your Account is closed.

We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate equal to 1/365 of the interest rate to the collected balance in the account each day. Interest will begin to accrue no later than the next business day following the banking day on which the funds were deposited.

1.7 Confidentiality and Our Privacy Policy

Information about your Account and your transactions is collected pursuant to the Agreement. The Program Partner’s privacy policy is available at https://www.topkey.io/privacy-policy.

1.8 Deposits Into Your Account

You may make deposits into your Account using any of these methods described below. We do not charge you any fees for making deposits.

1.9 Our Funds Availability Policy

It is our policy to make deposits to your Account available for withdrawal according to the table provided in the “Our Funds Availability Policy” section of the Agreement, except where limited by us pursuant to the “Transfers To or From Connected U.S. Bank Accounts” section of the Agreement.

Your Account supports the following types of deposits and cut-off times:

1.10 Withdrawals From Your Account

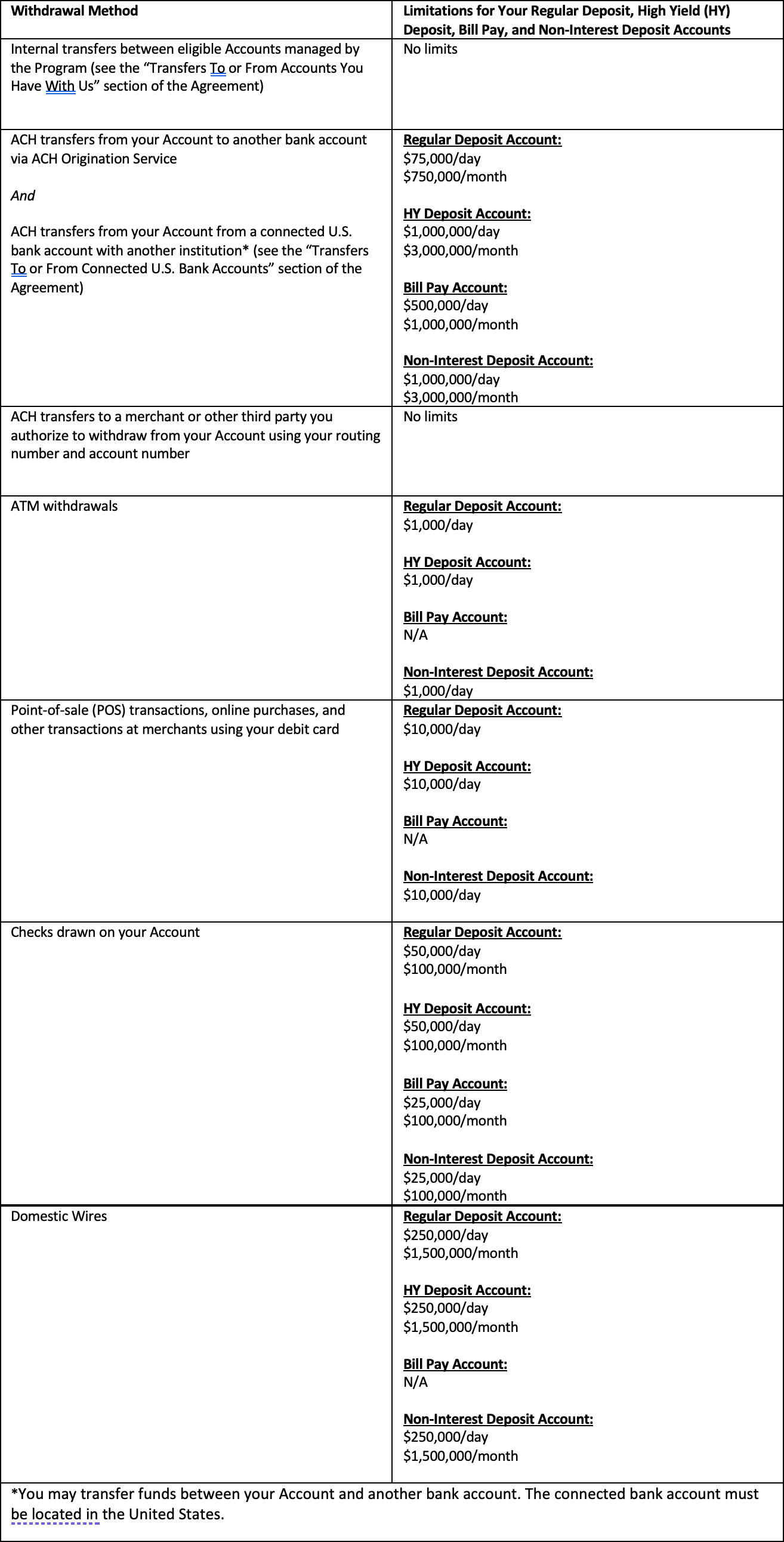

You, or, if applicable, an Authorized User, may withdraw funds up to the amount of your Available Balance less applicable fees using any of the methods below and subject to the following limits:

1.11 Overdraft Services

We do not offer overdraft services or charge fees for overdrafts or non-sufficient funds. We typically will return or decline to process a transaction (including, where applicable, ATM and debit card transactions) if it exceeds your Available Balance.

However, it is still possible for you to overdraft your Account, such as when you write checks (since there is a delay between when you write the check and when we receive it for processing), when we settle authorized debit card transactions, as discussed in the “Debit Card Authorization” section of the Agreement, or if a deposit you make is returned.

You must make a deposit immediately to cover any negative balance, including a negative balance resulting from an overdraft. If your Account has a negative balance for sixty (60) calendar days or more, we may close your Account. We reserve the right to close your Account at an earlier date, as permitted by law.

1.12 Fee Schedule

1.13 Types of EFTs Supported by Your Account

Your Account supports the following types of EFTs:

▪ Direct deposits

▪ Transfers your Account and a connected bank account.

▪ Transfers to or from your Account by a third party, such as payments you make to a vendor or

employee, or payments you receive from a customer or client.

▪ Transfers to or from your Account to a merchant or other third party by providing the third

party with your debit card or debit card information.

▪ Purchases or other transactions using your debit card.

▪ ATM withdrawals using your debit card.

1.14 ACH Origination Service Applicability

The ACH Origination Services is enabled for your Account; therefore, the ACH Origination Service section of the Agreement applies to your Account.

1.15 Check Deposits, Mobile Deposit Services, and Check Writing Applicability

The Check Deposit Services are enabled for your Account; therefore, the Check Deposits, Mobile Deposit Services, and Check Writing section of the Agreement applies to your Account. You can deposit checks via iOS and Android.

1.16 Wire Transfer Applicability

Wire transfers are enabled for your Account; therefore, the Wire Transfers section of the Agreement applies to your Account.

1.17 Debit Card Applicability

Debit cards are enabled for your Account; therefore, the Cardholder Agreement applies to your Account.

1.18 Authorized Users Applicability

You are permitted to designate Authorized Users for your Account.